Qbi deduction calculator

There are two ways to calculate the QBI deduction. 60000 0702 27500.

20 Qbi Deduction Calculator For 2021

199A Deduction Calculator 2018 Enter Information Single or Married Enter then tab to next cell Taxable Income Net Capital Gains and Dividends.

. Help you understand how to use ProSeries to calculate the QBI deduction. Intuit ProConnect has developed the QBI Entity Selection Calculator to provide in-depth computations of the qualified business income deduction according to IRS. Qualified Business Income QBI For.

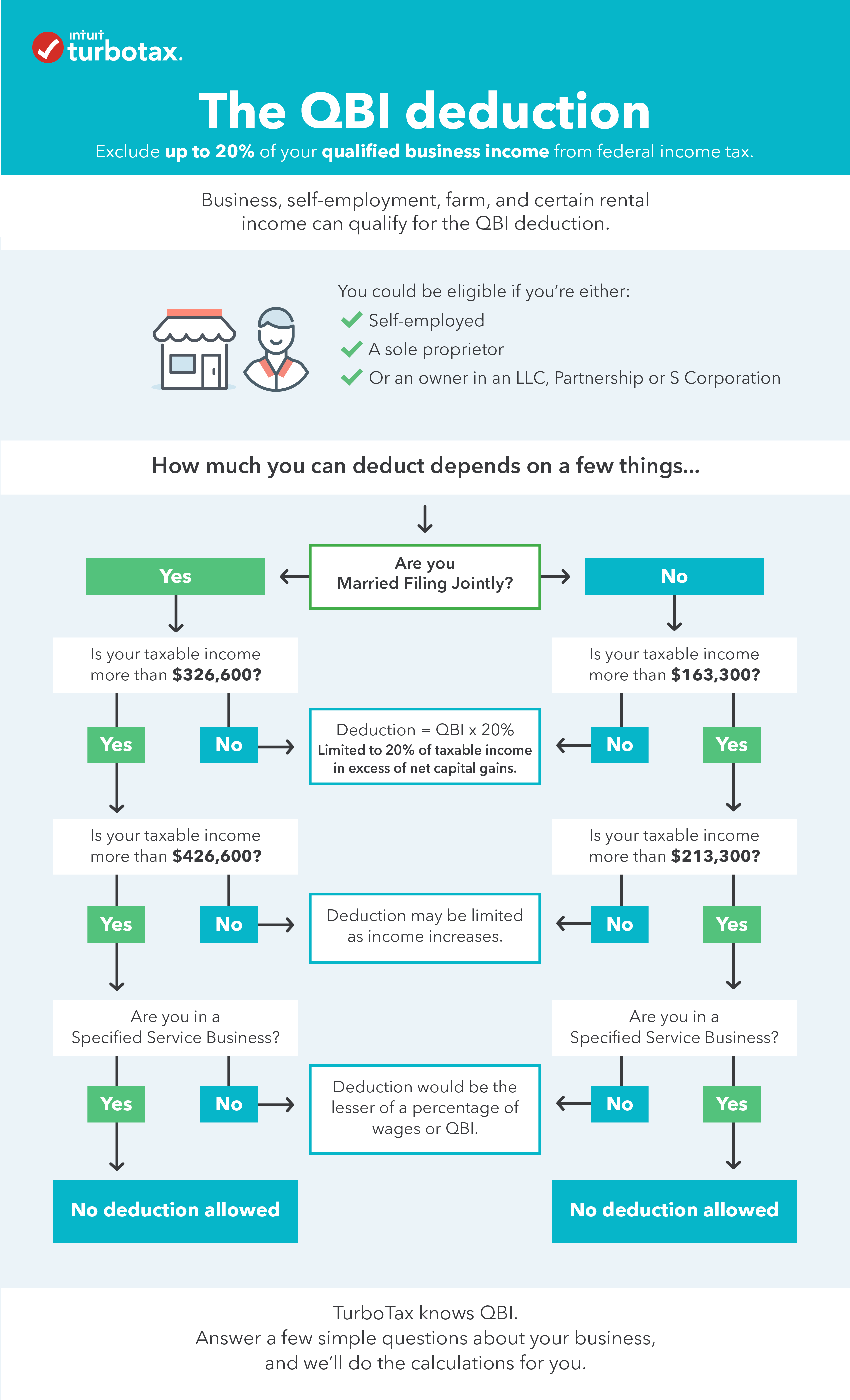

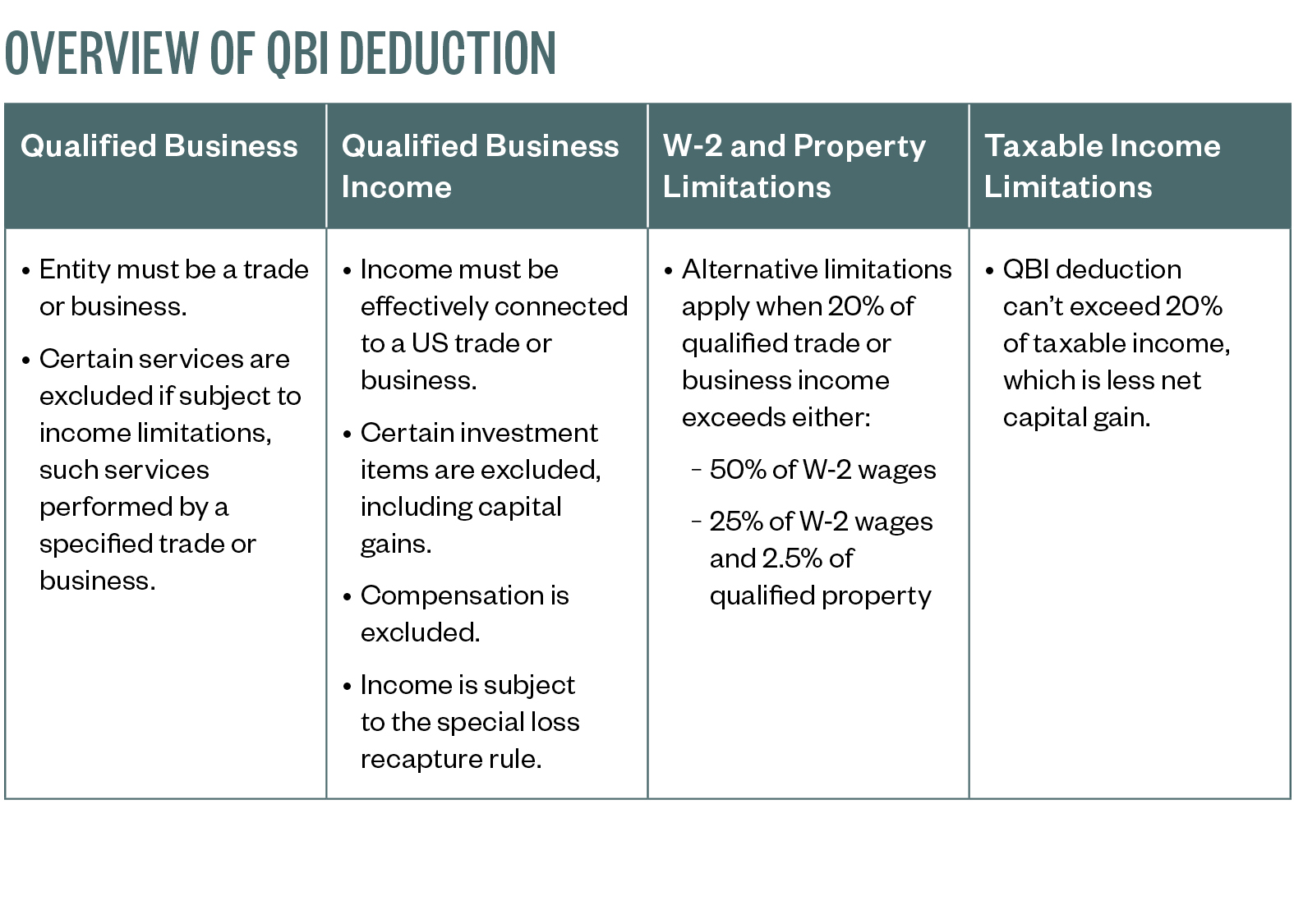

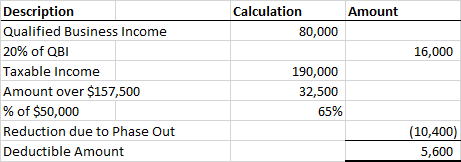

50000 QBID Greater of 50 W-2 wages or 25 W-2 wages plus 25 Qualified Property Unadjusted Basis BOX B QBID 20 of Qualified Business Income QBI QBID 20 of Qualified Business Income BOX A Prorate difference. If a taxpayers taxable income is less than 164900 329800 if married filing jointly then no matter the type of business they can take the full 20 percent QBI deduction. QBI wages and qualified property reduced proportionately to the taxable income in excess of threshold amount vs.

Tax after QBI deduction. Using the simplified worksheet or the complex worksheet. Tax before QBI deduction.

QBI Calculator 2021 This calculator will calculate your applicable Qualified Business Income Deduction also known as the Pass-Through Business Income Deduction. Difference Between QBI and Greater of WagesAssets Reduction to QBI Phaseout Deduction Calculation for Non-Service Business Above Phaseout 20 of QBI or Defined Taxable Income. The QBID Calculator is no longer active on the Tax School website.

The deduction allows eligible taxpayers to deduct up to 20 percent of their qualified business income QBI plus 20 percent of qualified real estate investment trust REIT dividends and. The QBI deduction for Jack and Jills restaurant business works out to. 78 rows QBI Entity Selection Calculator This worksheet is designed for Tax Professionals to evaluate the type of legal entity a business should consider including the application of the.

1 the 12 SE tax deduction 2 Self Employed Health Insurance deduction and 3 employer retirement contributions need to be subtracted from your business profit to. The QBI deduction allows eligible individuals to deduct up to 20 percent of business-related taxable income. Prior Year 199A Deduction Calculators Phase-In Taxable Income Threshold 2020 Calculator 2019 Calculator.

You have QBI qualified REIT dividends or qualified PTP income or loss. Were concerns about how to determine net capital gain for. 157500 if single estate or trust.

The QBI deduction will flow to line 10 of Form 1040 or 1040-SR or line 38 of Form 1040-NR. QBID Calculator updated for 2019. 1 Total calculated QBI deductions for all PTBs included below.

20 of QBI reduction ratio excess amount QBI deduction. Status Beginning Ending 2018 Calculator. There are different income thresholds for single-filers and.

New Updates This Year For The 20 Qbi Business Deduction Alloy Silverstein

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

Do I Qualify For The 199a Qbi Deduction

How To Calculate The 20 199a Qbi Deduction Very Detailed 20 Business Tax Deduction Explained Youtube

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

1040 Tax Planner Qualified Business Income Deduction Drake17

Do I Qualify For The Qualified Business Income Deduction

Qbi Calculator Wilson Rogers Company

New Qualified Business Income Deduction

Update On The Qualified Business Income Deduction For Individuals Seeking Alpha

What S With This 20 Deduction On Pass Through Income And Will It Help Me Wffa Cpas

New Updates This Year For The 20 Qbi Business Deduction Alloy Silverstein

Calculation Of The 20 Deduction For 2018 Pass Through Entities Steemit

Qbi Deduction Frequently Asked Questions K1 Qbi Schedulec Schedulee Schedulef W2

Overview Of The Qualified Business Income Qbi Deduction

20 Qbi Deduction Calculator For 2021

Using A Qualified Retirement Plan To Take Advantage Of Tcja Provisions The Cpa Journal